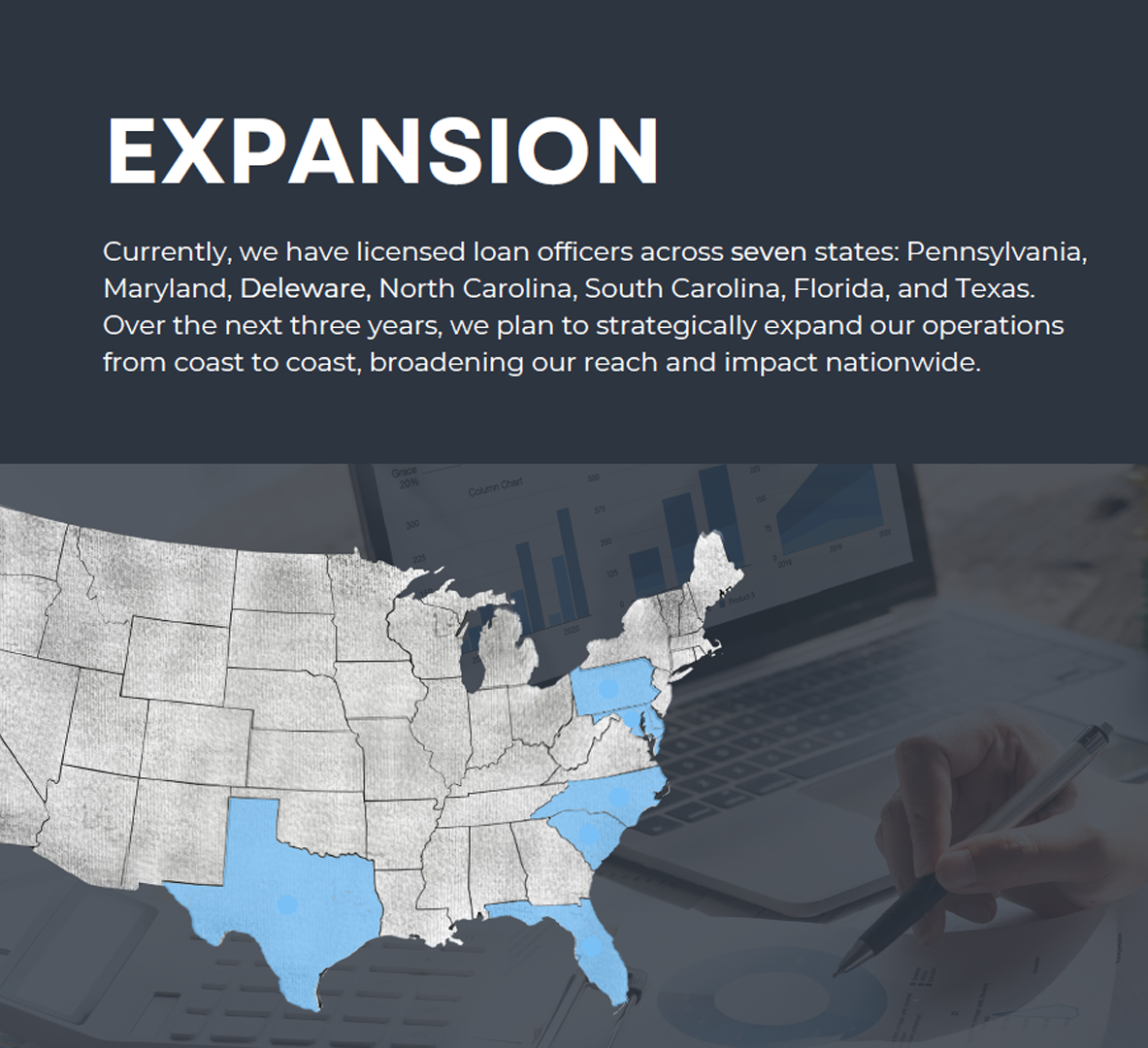

717 Mortgage Group, founded in 2022 by CEO Justin Robitaille, began its journey with a single licensed Loan Officer in Pennsylvania. Since then, we have rapidly expanded our operations to six states, employing a dedicated team of ten Loan Officers. With a clear vision for growth, we aim to be

operational in 20 states by the end of 2024 and all 50 states by the close of 2026.

Our success is built on a foundation of consistently offering the lowest possible rates while providing outstanding customer service. At 717 Mortgage Group, we prioritize treating our clients with honesty and integrity, ensuring that every interaction is a positive and trustworthy

experience.

We take the time to get to know you personally, allowing our seasoned loan officers to offer tailored financing solutions that meet your unique needs. Proudly, we have financed thousands of loans, helping Americans find, keep, and afford their dream homes.